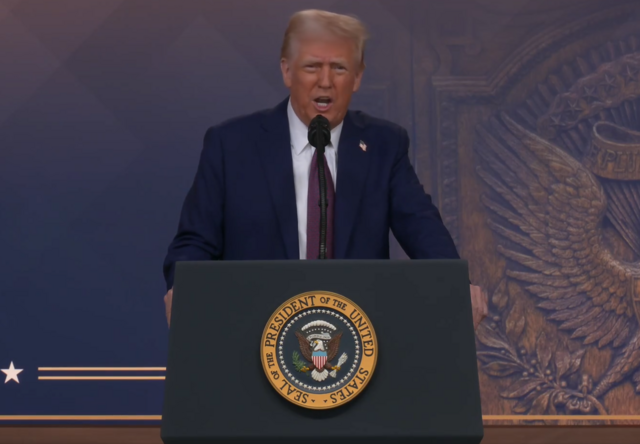

A fierce debate is brewing in Washington over the state and local tax (SALT) deduction, a tax break that lets people subtract certain state and local taxes from their federal taxable income. With a current cap of $10,000, a new proposal to raise it to $30,000 could ease the burden for millions—but it’s sparking heated arguments. While President Donald Trump pushes his “one big, beautiful bill” to make the 2017 Tax Cuts and Jobs Act (TCJA) permanent, the SALT cap issue is threatening to derail the plan. So, who really benefits from this deduction, and why is raising the cap such a contentious issue?

The SALT deduction lets taxpayers who itemize their federal returns deduct state and local income taxes (or sales taxes) and property taxes. Since the TCJA capped it at $10,000 in 2017, it’s been a lifeline mostly for higher earners in high-tax states like California, New York, and New Jersey. Back in 2017, before the cap, two-thirds of the deduction’s benefits went to households earning $200,000 or more, with the average deduction hitting $13,000—and even topping $30,000 in some wealthy counties. Fast forward to 2020, and only 8.6% of federal tax returns claimed the deduction, but it was heavily concentrated in 13 states and Washington, D.C., where 10% to 20% of filers in places like Maryland, California, and New York took advantage of it. For these folks—often upper-middle-class or wealthy homeowners—the cap has meant a smaller tax break than they’d like, leaving them frustrated.

Raising the cap to $30,000 could bring relief to these taxpayers, especially in high-cost areas where state and local taxes easily exceed $10,000. For example, a family in New York paying $25,000 in property and income taxes could deduct the full amount, saving them thousands on their federal taxes. But here’s where it gets tricky: the benefits aren’t spread evenly. The top 20% of earners would see their tax cuts grow by an average of $2,500 if the cap were lifted, while the top 1%—those earning over $430,000—would gain even more, with tax cuts averaging $71,000 instead of $40,100. Meanwhile, the bottom 80% of taxpayers, most of whom take the standard deduction (which is $15,000 for singles and $30,000 for married couples in 2025), wouldn’t see much change at all. This lopsided benefit has critics calling the SALT deduction a “subsidy for high-tax states” that mostly helps the rich, making the tax code more regressive.

The proposal to raise the cap is causing a rift among Republicans. Lawmakers from high-tax blue states are pushing hard for relief, arguing their constituents—think well-off professionals in places like San Francisco or Manhattan—are getting squeezed by the $10,000 limit. They’ve got a point: in states like California, where property taxes alone can top $10,000 for a modest home, the cap hits hard. But their colleagues from lower-tax red states, like Texas or Florida, see it differently. Their residents, who pay less in state and local taxes, barely benefit from the deduction, so they view raising the cap as a handout to wealthy blue-staters. This has led to tense intraparty battles, with some GOP members worried that the $915.6 billion cost of the $30,000 cap over 10 years (according to the Joint Committee on Taxation) could balloon the deficit without helping their own voters.

The timing of this debate adds another layer of complexity. Trump’s broader tax agenda, including the Golden Dome missile defense system, is already straining budgets. With ice sheets melting and coastlines at risk—potentially displacing 230 million people worldwide—some argue that resources should focus on climate adaptation, not tax breaks for the wealthy. Others see the SALT cap fight as a distraction from bigger issues, like curbing emissions to slow the ice melt. On the flip side, supporters of raising the cap say it’s about fairness—why should people in high-tax states be penalized for their state’s policies? They argue the deduction, which has been around since 1913, was meant to prevent the federal government from overtaxing state revenues.

As the House prepares to vote on the bill as early as tomorrow, the SALT cap debate is a stark reminder of the trade-offs in tax policy. For high earners in pricey states, a higher cap could mean real savings. But for the majority of Americans—and for lawmakers balancing a tight budget—it’s a tough sell. With global challenges like rising seas and geopolitical tensions looming, the fight over SALT shows just how hard it is to align national priorities with local needs.